Cost and Demand

Welcome to Pan Biao's personal website!

sun@china.com. Please give me your advice! And you are welcome to reprint it for free.

Your spread can make history!

The Fatal Error of Economics

Pan Biao

The entirety of economics is based on a theory that is contrary to the real world.

1. The theory of supply and demand is the foundation of microeconomics. In fact, it is also the foundation of macroeconomics, but the name has been changed to total supply and total demand. The graphics and analysis methods are almost the same.

2. The supply curve slopes upward to the right. The higher the price, the more supply. Why? Because the more you produce, the cost is getting higher and higher (marginal cost). Why? Because of the law of diminishing returns.

3. What is the law of diminishing returns? In layman's terms, it means that the increase in output is getting lower and lower (input doubles, and the harvest increases by 50%). Why? In ancient times, the population increased rapidly and the arable land was exhausted. If you want to continue to produce more food, you can only continue to increase input on the already full arable land. Of course, the increase in harvest will become lower and lower, that is, the more you produce, the higher the cost.

Ancient economists summarized the production law of ancient agriculture and used it as the supply curve.

4. Human history has entered the industrial age and the information age! When you go shopping, you always find that the more you buy, the cheaper you get. Why? Because the more manufacturers produce, the cost is getting lower and lower! [That is, in the real world, the supply curve slopes downward to the right!] Why? Reasons: 1. Technology (information) costs can be replicated at no cost. 2. Economies of scale.

Modern production laws are completely different from those in ancient times. The cost of producing the first piece of information products (such as software) is very high, and the cost from the second piece onwards is zero and the output is infinite - you can never come to the conclusion of modern economics that the more you produce, the higher the cost and the smaller the increase in output.

5. When ancient economists proved that the supply curve of ancient agriculture tilted upward to the right, they gave the reason that arable land was exhausted.

When modern economics path-dependently determined that the supply curves of industry and information industry also tilted upward to the right, it did not prove what caused it! Is it that industrial land was exhausted? Or oil was exhausted? Or everyone in the world was employed?

On the contrary, modern agriculture has serious consequences due to the large amount of vacant arable land in the world: it has shaken the foundation of modern economics - the conditions for the formation of the law of diminishing returns no longer exist! And due to modern planting, economies of scale are generated, and the more you produce, the lower the cost.

6. Modern economics analyzes various issues based on the supply curve that slopes upward to the right. But if the supply curve in the real world is not like that, we will get a conclusion that contradicts the real world! So, economics based on the theory of supply and demand is basically... you know!

Should you choose to bravely believe in the facts and trust your own judgment, or continue to blindly believe in authority?

7. Want to learn more about real-world economic laws? Please read: Modern Economics Only Applies to Ancient Times (Cost and Demand Theory) .

Cost and Demand Theory

Modern Economics Only Applies to Ancient Times(Cost and Demand Theory)

Pan Biao

Why can modern economics only be used to explain ancient society? Can not be used to explain modern society? Well, it's a bit like Newton's mechanics is not enough to explain the modern world. Later, quantum mechanics and relativity came into being.

Facing the truth bravely or superstitious authority?

Everyone knows that the foundation of economics is a theory called "supply and demand". Open any economics textbook, The starting point is to introduce this theory. See Figure 1.

In short, the demand curve means that the lower the price of a commodity, the more consumers will buy; while the supply curve is just the opposite, the higher the market price, the more producers will produce. The intersection of the two curves constitutes the price.

Of course, this theory has also become the foundation of macroeconomics, known as the "aggregate supply and aggregate demand" theory, with similar graphical and analytical methods. For instance, when analyzing inflation, it is caused by an excess of aggregate demand, which shifts the curve to the right and intersects the aggregate supply curve at a higher price point.

Why does the supply curve indicate that the higher the price, the more goods will be produced? According to modern economics, this is because the more goods a manufacturer produces, the higher the cost. However, in the real world, the opposite is true!

When you go shopping, whether it is as small as a pins, cookies, Windows 11, or as big as a TV, sofa, car... the more you buy, the cheaper it is! Why is this so? Because the more goods a merchant buys from a manufacturer, the cheaper it is! Why is it that the more goods a merchant buys from a manufacturer, the cheaper it is? Because the more a manufacturer produces, the cheaper it is!

If the supply curve in the real world today is not like that of modern economics, then economics based on supply and demand theory is basically... You know!

In ancient times, the most important product for humans was agricultural products. Therefore, it is not a problem for ancient economists to summarize the production laws of agricultural products as the supply curve. The problem is that human history has not only entered the industrial era! Human history has entered the information age! There are more important industrial and information products, whose production laws are completely different from ancient agricultural products!

Let me give you an example of an information product and you will understand it at a glance.

For example: application software, short videos, games, online novels, popular music... The characteristic of information products is that manufacturing the first product requires a high cost, but starting from the second product, the cost is zero and the output is infinite! Because it can be produced by automatic copying - you can never draw the current economic conclusion that the more production, the higher the cost, and the less the output growth.

Ask yourself, do you choose to believe in facts and your own judgment, or continue to believe in authority? It takes great courage to believe the truth!

Real world supply curve

I know many people will say after reading: it is the average cost pricing! Except modern economics don't know, the whole world knows that this is the most common pricing method. Aren't you wasting everyone's time?

In fact, the significance of this paper is to prove why enterprises use average cost to price.

Take automobiles, one of the most important commodities in the industrial era, as an example. Major automobile companies invest a huge amount of money every year in the research and development of new models (for example, Volkswagen invested the equivalent of 110 billion yuan in research and development in 2023). Every car we buy now includes the cost of research and development.

Assuming that Ford invests about 10 billion yuan every few years to develop a new model of about 100000 yuan, each new model can sell about 1million vehicles. [Based on this, it can be deduced that the R&D cost of each vehicle is about 10,000 yuan, that is, 10 billion yuan divided by 1 million vehicles. The remaining costs of each vehicle (including raw materials, factory buildings, machinery, labor, energy, etc.) are about 90,000 yuan.]

This time, Ford invested another 10 billion yuan to develop a new car. This happened to coincide with the signing of a peace agreement among oil-producing countries, which led to a sharp drop in oil prices and a surge in demand for cars, up to 1.5 million vehicles. So, how should Ford set the price?

According to the theory of modern economics, enterprises are priced according to marginal cost. (Marginal means newly added, and marginal cost refers to the newly added cost generated by the increase in production. It is precisely because as production increases, the production cost of each product gradually becomes higher, that the supply curve curves upwards to the right.).

So, Ford has increased its production by 500,000 units this time. What is the cost (i.e., marginal cost) of these 500,000 additional units? It's 90,000 yuan per vehicle! Strange, in the past when producing 1 million units, the cost per vehicle was clearly 100,000 yuan. Why is it that with the addition of 500,000 units, the cost decreases as production increases?

Because for the additional 500,000 units produced, there's no longer a need for research and development expenses!!! Industrial products have a characteristic: technology can be replicated without cost! When you increase production, there's no need to conduct new research and development; simply follow the previous drawings and processes.

Coming back to the previous question, how should we price these 1.5 million vehicles? If we adopt the marginal cost pricing method in economics, each vehicle would be sold for 90,000 yuan. However, we would never be able to recover the 10 billion yuan invested in research and development! Therefore, no company would follow the principles of economics!

In other words, the company can only set a higher price. How high should it be? In the past, the price of a new model produced in 1 million units was set at 100,000 yuan per unit. This time, the demand for the new model has increased significantly. Logically, setting a higher price, consumers will also accept it. Okay, let's assume that Ford sets the price at 130,000 yuan per unit.

What happens in a perfectly competitive market?

At this point, General Motors, seeing the potential profit, will immediately set the price of a new model of the same grade at 120,000 yuan, aiming to capture Ford's market. For Ford, the consequences are very serious, which will lead to the inability to sell their new cars!

Similarly, Volkswagen saw that it was profitable and quickly priced its new model of the same level at 110,000 yuan. Toyota also saw this and quickly priced its new model of the same level at 100,000 yuan! Do you think that’s enough? BYD took a look and priced its new model of the same level directly at 96,700 yuan!!!

Finally, all car companies can only set the price of this new model at around 96,700 yuan!

(In reality, there are some differences in the prices of vehicles of the same level among major car companies, but when converted into cost-effectiveness, they are all similar.)

Wait a moment. In previous competitions, didn't Ford set the price of its new model at 100,000 yuan? If the price is set at 96,700 yuan this time, won't it incur losses?

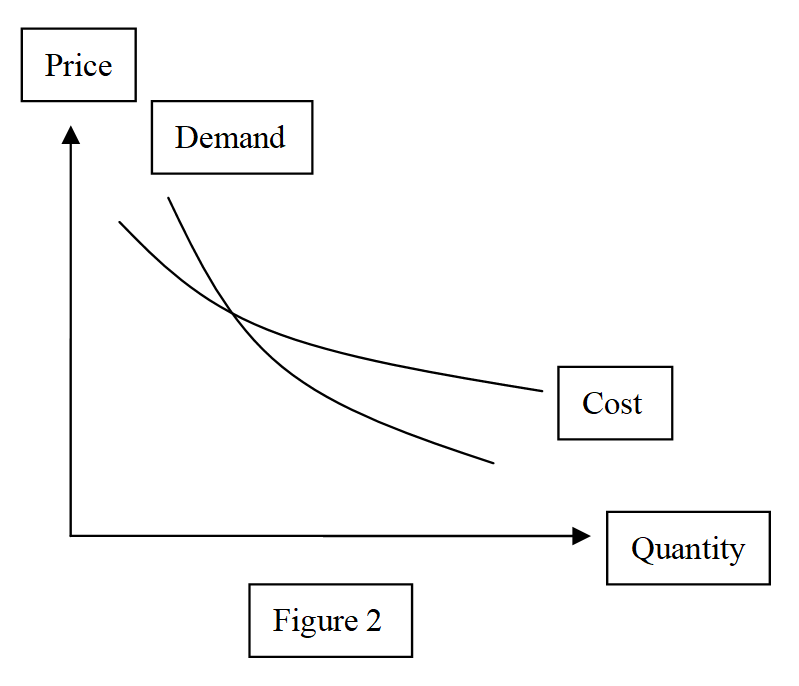

No, it won't. Because the production volume this time is 1.5 million vehicles. Dividing the R&D cost of 10 billion yuan by 1.5 million vehicles, the R&D cost per vehicle is only 6,700 yuan. Plus other costs of 90,000 yuan, it's exactly 96,700 yuan. In other words, through perfect competition, the final price that major car companies compete with each other can only be the average cost price. Because if the price war continues, everyone will lose money - that is, the supply curve of perfectly competitive enterprises can only be the average cost curve. As shown in Figure 2. I call my theory the: Cost and Demand Theory.

Analysis method of cost and demand theory

When demand increases, the demand curve shifts to the right, intersecting the cost curve at a lower position, resulting in a decrease in price and an increase in sales volume. (The opposite occurs when demand decreases, and the analytical method remains the same.).

When costs decrease, the cost curve shifts downward, intersecting the demand curve at a lower position, resulting in a decrease in price and an increase in sales volume. (The opposite occurs when costs increase, and the analysis method remains the same).

Current economics teaches us that the higher the price, the greater the supply; the lower the price, the less the supply.

However, Cost and demand theory holds that, It's not that the higher the price, the greater the supply! Instead, as long as the price is higher than the cost (that is, the current price, that is, the intersection of cost and demand curve), enterprises can supply countless! (relative to human needs). Because the more enterprises produce, the lower the cost, as long as there is demand in this price market, they will work hard to produce!

It's not that the lower the price, the less the supply. Rather, as soon as the price falls below the cost, the supply becomes zero! As the saying goes, there are people who will do business even if it means risking their lives, but no one will do business at a loss.

Therefore, when something becomes cheaper the more it is produced, the supply curve of modern economics, which determines the output according to the market price, no longer exists. In reality, companies can supply an unlimited amount of goods at the current price (i.e. cost) (as long as there is demand), so there is simply no opportunity for the situation where higher prices lead to more supply to occur.

Instead, it is replaced by the average cost curve: companies adjust supply prices according to the increase or decrease in demand, a market signal (rather than adjusting output according to price, a market signal, as in current economics): when market demand increases, output is increased, and supply prices fall due to lower costs (the same applies when demand decreases).

Why does modern economics lead to marginal cost pricing?

So, how does the marginal cost pricing (i.e., the supply curve is the marginal cost curve) of enterprises in modern economics come about? Here is my proof.

In the past, a landlord hired five farmers for 100 copper coins, and invested another 300 copper coins in other costs (including cattle, land, seeds, fertilizer, farming tools, etc.). The total cost was 400 copper coins, and 800 kilograms of grain were produced. The market price was 0.5 copper coins per kilogram, which was exactly equal to the landlord's investment cost. Therefore, the landlord's profit in perfect competition was zero (in economics, zero profit refers to zero excess profit. That is, only normal micro-profits were obtained. The normal micro-profits have already been included in the landlord's investment cost. The same applies to the example of the car mentioned above, where normal micro-profits are already included in the average cost).

Then, a significant issue arose!

With the continuous surge in population, the demand for food has been steadily increasing. At the same time, all the arable land has been planted and cannot be increased. At this point, the price of grain has reached 1 copper coin per kilogram.

Therefore, in this crop, the landlord hired 5 more farmers for 100 copper coins. Because the cultivated land could not be increased, now 10 farmers were put into the original land. These extra hands could only weed, drive away birds, catch insects more frequently... to make the harvest as much as possible. Finally, the harvest reached 900 kilograms.

Let's calculate: In the previous crop, the landlord could produce 2 kilograms of grain for every 1 copper coin invested. In this crop, the landlord has newly invested an additional 100 copper coins. Based on the previous situation, an additional 200 kilograms of grain should be produced. However, due to the law of diminishing returns (i.e., the newly added benefits continue to decrease, meaning that the more you produce, the higher the cost), only an additional 100 kilograms of grain can be produced.

The question arises: why would the landlord still work even though the yield has decreased by 100 kilograms compared to before? - Because the grain price has reached 1 copper coin per kilogram at this time!

The landlord's newly increased investment of 100 copper coins can be sold for 100 copper coins, which just covers the cost, with a profit of zero. In other words, if the grain price does not reach 1 copper coin per kilogram, the landlord will not increase his investment, otherwise, this newly increased investment will result in a loss.

So, can the landlord sell at a high price? For example, selling for 1.1 copper coins per kilogram. No, it won't sell because there are countless competitors in the market who are competing to lower the price, eventually driving it down to only 1 copper coin per kilogram. It can't be lowered any further, otherwise everyone's newly increased investment will result in a loss - that's right! This is what is called marginal cost pricing in economics!

However, the total investment for this crop was 500 copper coins, and the total harvest yielded 900 kilograms, which could be sold for 900 copper coins. The landlord made an excessive profit of 400 copper coins! - This is exactly the opposite of one of the most important conclusions in economics: that corporate profits are zero in perfect competition and that the market economy is efficient.

So, how did economics come to the conclusion that the profit of enterprises in perfect competition is zero? The economic deduction is: when there is excess profit in a certain industry, more enterprises will join in production, which will increase supply (that is, the supply curve shifts to the right), and push down prices until the profit is zero.

But the problem is that the law of diminishing returns holds true precisely because resources (farmland) are depleted! When farmland is no longer increasing, may I ask what other enterprises that wish to join the production process will use to produce grain?!

Therefore, one of the most important conclusions of Economics: the law of diminishing returns, is contradictory to one of the most important conclusions of Economics: Zero profits of enterprises in perfect competition.

Only within the framework of cost and demand theory can we draw the conclusion that the profit of enterprises in perfect competition is zero!

(In fact, even if this batch of landlords did not make additional marginal investments and invested as usual, there would be no marginal benefits, and they would only harvest 800 kilograms, but would still earn a huge profit of 400 copper coins! But without the normal small profit from marginal input).

Why did ancient economists come up with the law of diminishing marginal returns?

So, why did ancient economists come to the conclusion that the more supply, the higher the cost, that is, the law of diminishing returns? In fact, this was true in the agricultural era!

The reasons can be summarized as follows: population explosion and technological stagnation. As Malthus once put it, the population is growing exponentially. While technology has seen little significant progress for thousands of years.

If you look at the explanations of supply and demand theory in various modern economics books, the examples given are basically: wheat, corn, grapes, tomatoes, etc. This is because in the agricultural era, the most important products of human society are crops. And often the population grows too much while the arable land is limited.

When explaining why the more supply there is, the higher the cost, economics believes that due to limited land, in order to produce more agricultural products, more manpower, seeds, and so on can only be invested on the same piece of land. As the land is increasingly densely cultivated, the output cannot increase in proportion to the input, and the increased output becomes less and less, naturally leading to higher and higher costs.

[Therefore, there are conditions for the diminishing returns. The first condition is that in the production of products (such as food), some resources no longer increase (such as arable land in ancient times).

When ancient economists explained the diminishing marginal returns of grain production in ancient times, they gave the reason of "exhaustion of arable land". Then, when modern economics path-dependently determines that the marginal returns of industry and information industry are also diminishing and the supply curve is tilted upward to the right, it must also prove what the cause is! Is it that the industrial land has been exhausted, or the oil has been depleted, or that everyone in the world is fully employed? ]

Why is there no diminishing return in modern agriculture?

First, because population growth has slowed sharply, many countries are now calling for fertility to be too low. At the same time, with the rapid development of science and technology, chemical fertilizers, pesticides, tractors, harvesters, genetically modified crops have been invented... New land is constantly being cultivated. Making the growth rate of grain production exceed the growth rate of population, resulting in a large number of vacant arable land in the world today!

What does a large amount of vacant farmland mean? The consequences are very serious! Shaking the foundation of modern economics!!! This means that the conditions for the formation of the law of diminishing returns, which is the foundation of the supply curve in modern economics, no longer exist!!!

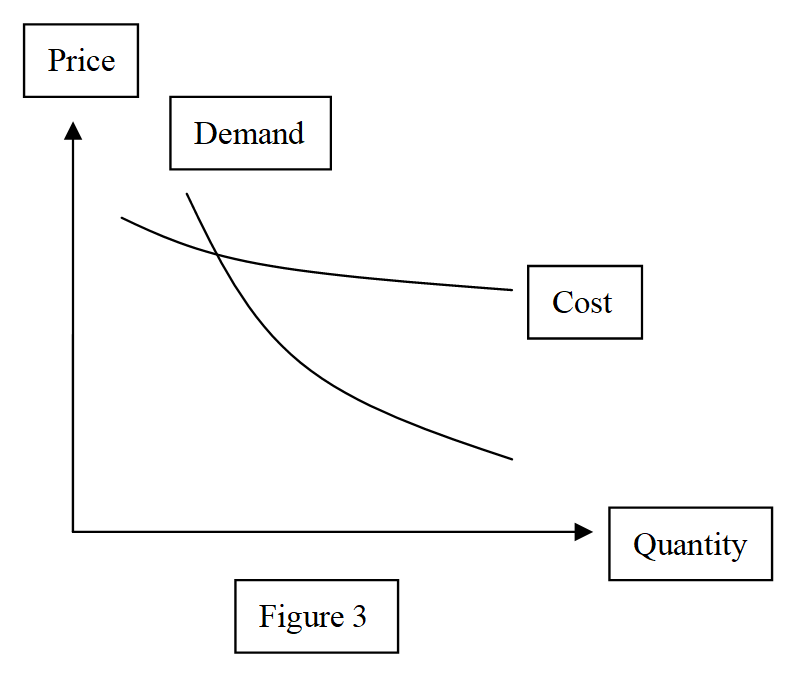

When the farmland is fully cultivated and the planting density is further increased, only diminishing returns can occur. However, when the farmland is left unused, the opposite occurs, manifesting as economies of scale (i.e., the larger the scale, the lower the cost). Because mechanized planting is the larger the planting area, the lower the cost. Therefore, the supply curve of modern agriculture is also a downward sloping average cost curve to the right, as shown in Figure 3.

The supply curve depicted in Figure 3 is also applicable to low-end manufacturing and commerce, as they also adhere to economies of scale.

Low-end industrial products, such as ordinary clothing, footwear, stationery, and personal care products, do not incur research and development costs. Therefore, they cannot achieve significant cost reductions through scale expansion, as high-end manufacturing industries (such as automobiles) or the information industry do, thereby forming a strong economies of scale. To facilitate understanding, I have drawn their average cost curve with a less steep slope compared to that of high-end manufacturing industries.

How does low-end manufacturing generate economies of scale? mainly factory buildings, machines, executive salaries, funds... these major costs, when production increases significantly, in addition to overtime, two or even three shifts can be adopted, then these costs will be reduced to 1/2 or even 1/3 of the previous ones. As for labor, although overtime pay has increased, various security benefits have been diluted. What if production continues to increase significantly in the long run? Just build a new factory!

How does commerce generate economies of scale? Mainly the shop rent, labor... these major costs, the more goods are sold, the more these costs are diluted.

Actually, products in today's world are basically economies of scale! Look at the giants in today's world: Tesla, Wal Mart, Amazon, Toyota, Aramco, Boeing, Coca-Cola... Which is not the larger the scale, the lower the cost?!

Paul Samuelson wrote in his world's best-selling economics textbook "Economics": One of the most famous laws in all economics, the law of diminishing returns.

In this regard, I believe that one of the most famous laws in all economics, the law of diminishing average cost.

Is it possible to have diminishing returns in modern times?

So, is it possible for modern industry to experience diminishing returns that are consistent with economics?

Assuming that interest rates are cut sharply now, the demand for cars will surge, then the surge in demand for iron ore and power will indeed cause a short-term increase in the prices of these resources (the more production, the higher the cost of these resources). But what happens next? The demand for cars plummets, because if you buy one now, you won't buy it again within 10 years. Then, these resources that have temporarily increased in price will fall back to their original prices. The underlying logic is: the population has not increased significantly.

So, even if there is a temporary increase in resource prices, Will there be diminishing returns for automobiles in the short term?

Assuming that the average research and development cost per vehicle is 20,000 yuan, if sales double, Then, the demand for iron ore and energy surged. However, unlike arable land, these resources are not depleted, but rather, the cost of extraction increases if more is mined.

So, a situation arises: the rise in these resources has led to a 2000 yuan increase in car costs, but, but, the average research and development cost has dropped by 10000 yuan! As a result, the car price has actually dropped by 8000 yuan!

Why is this counterintuitive? Because when the R&D cost of 10 billion yuan is used to produce only 10,000 vehicles, the R&D cost per vehicle is as high as 1 million yuan! If the production volume is expanded tenfold, the R&D cost per vehicle will drop dramatically to only 100,000 yuan! That is, the sky-high R&D cost decreases dramatically due to a sharp increase in production volume, far exceeding the rise in resource prices.

[Therefore, the second condition that causes diminishing returns is: even if resources no longer increase (for example, the production speed of lithium for new energy vehicles could not keep up with the surge in demand for a period of time, and speculation led to a price increase of lithium batteries), the resulting increase in resource costs must be greater than the cost reduction caused by economies of scale (for example, the extremely strong economies of scale in the automobile industry have led to a sharp drop in the prices of new energy vehicles, which cannot lead to diminishing returns). ]

Let me make another assumption. If the population grows significantly like in ancient times, will it lead to diminishing returns? No, it won't. Because a significant population growth takes time, let's say 25 years for one generation. But during these 25 years, human technology has grown significantly again, eliminating the causes of resource depletion!

As we all know, the marginal cost curve in economics goes down at the beginning, but when the cultivated land is fully planted and the law of diminishing returns is triggered, the marginal cost will continue to go up.

Therefore, as long as we keep resources from being depleted, marginal costs will not rise - This is the way the world is today! How can we keep doing this? Just keep scientific and technological progress greater than population growth!!!

Okay, if we have to write a science fiction novel that depicts a future where population grows exponentially but technology stagnates, will there be a law of diminishing returns in industrial products? This will happen. (At this time, the company's supply curve will automatically change from the average cost curve to the marginal cost curve, and the price will be determined according to the marginal cost. Therefore, modern economics is basically invalid in modern times, It is not that modern economics is wrong, but that the times have changed. In modern society, basically no products are priced according to marginal costs).

But please remember, this kind of thing is only written in science fiction, but not in economics. Because the most fundamental reason why the law of diminishing returns fails is that technology grows at a cubic rate!!!

The supply curve of information products

Oh right, Haven't derived the supply curve for information products yet!

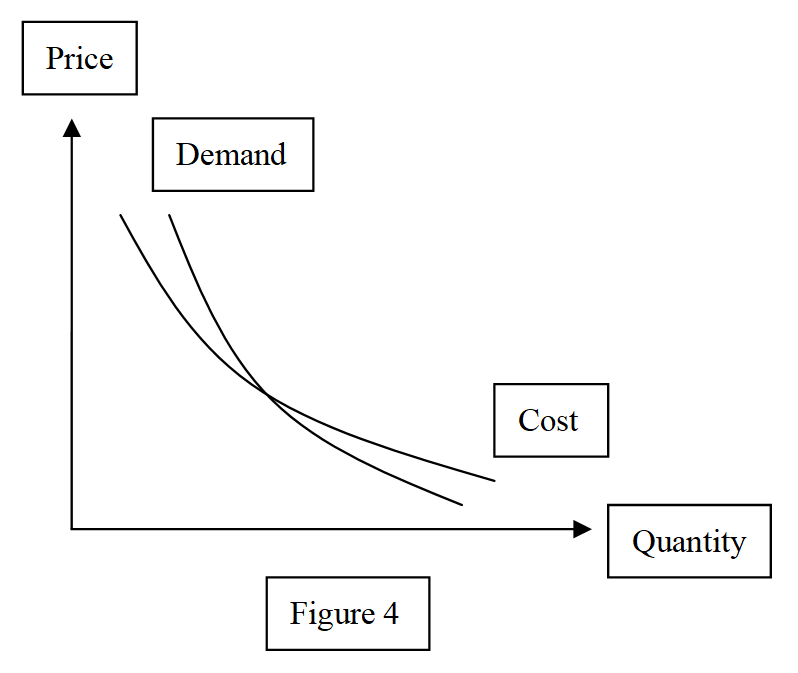

For perfectly competitive information products, its supply curve can also be derived according to the above-mentioned idea of the car.

Firstly, the marginal cost of information products is zero, so it is impossible for anyone to price them based on marginal cost as stated in current economics. What if they set a high price? For example, if a financial software or antivirus software is priced high, other strong competitors will undercut each other until they can only obtain normal meager profits with zero excess profits.

The difference between information products and industrial products is that industrial products have physical costs (materials, energy, labor, machinery, etc.) in addition to technical (information) costs. However, information products have no physical costs during reproduction, and the average cost can be much lower than that of industrial products when producing more! Therefore, when drawing the average cost curve of information products, I deliberately drew it with a steeper slope than that of high-end industrial products, which is easier to understand. As shown in Figure 4.

The concepts of long run and average cost in modern economics

Since almost all companies in the real world use average cost pricing, what should modern economics do? It uses a concept that is generally recognized to be very vague: long run, to apply to average cost. It is believed that average cost pricing is only used by companies in the long run, and marginal cost pricing is still used in normal times.

The reason is: For example, in a clothing factory, when demand increases for a long run, the enterprise can keep the production cost unchanged by continuously building new factories and adding new machines to expand the scale. However, if the demand increases sharply in the short run, it will definitely not be able to build new factories and add new machines to significantly increase production. Increasing production can only be achieved by continuously recruiting workers and increasing manpower input, which leads to diminishing returns and rising marginal costs.

In fact, the long run, like marginal cost, is a concept that only existed in the ancient agricultural era. Let me give you an example of the Chinese game "Black Myth: Wukong" which is currently selling well all over the world, and you will understand it at a glance.

When this game demands 100,000 copies a day, the game company produces them in just 0.1 seconds! The production time is merely the instant when the system automatically confirms the payment made by the user online. As this game becomes increasingly popular, and the demand skyrockets 20 times in a single day, reaching 2 million copies, how long will it take to produce it? It's still 0.1 seconds! Because game companies can produce it without building new factories or adding new machines! - There is simply no such thing as the concept of long run!

So, why did the concept of long run exist in ancient times? Here is my proof.

The most important product in ancient times was grain, but grain production required a long period of time, about half a year to a year.

If the general environment in a certain place this year is similar to previous years, and the grain price is 1 copper coin per kilogram, then the grain price this year will probably fluctuate slightly around this price, which is approximately equal to the production cost.

However, if a flood occurs locally, destroying a significant portion of the farmland, the following day, everyone panics and rushes to buy grain while simultaneously being afraid to sell it. This is because grain cannot be produced in the short term, leading to a surge in grain prices (i.e., only through significant long run production increases can grain prices drop to a level equivalent to the cost price). Subsequently, famine ensues, causing grain prices to skyrocket even further.

In other words, in ancient times, the different impacts of long run and short run on agricultural product prices is a concept that has certain use.

So, what will happen to modern agriculture when it encounters the above situation?

When the media pushes to you: A flood occurred in the rural area of your province, and all the food was washed away. What will your reaction be? - You are not even interested in taking a look!!!

Why? Because you know, whether there's a flood or not, the price of rice in supermarkets and online stores remains at 5 yuan/kilogram, unchanged!!! Why was it a matter of life and death in ancient times, but has no impact in modern times? Because modern agriculture has four powerful tools: information, transportation, storage, and, most importantly, market economy!

In ancient times, a major famine occurred in a province, and it took a long time for the news to reach the central government. Then the central government organized disaster relief, purchasing grain from various provinces and transporting it to the affected provinces. During the long transportation process, the grain had already been depleted to a small amount. By the time this small amount of grain reached the disaster area, the population in the disaster area had also been reduced to a small number.

In modern times, when a province suffers from floods and a poor harvest, not only is the local large amount of stored grain enough to last for many days, but the next day, grain from surrounding provinces will automatically pour in! Similarly, if a country has a poor harvest, grain from all over the world will automatically pour in! - Everyone is rushing to do business!

Alright, let's talk about modern industry. In the real world, what should we do when an extremely rare situation occurs and the total demand for shirts increases by 50% in a short period of time? Just clear out the inventory and the problem is solved. Yes, it's that simple!!!

If we have to assume that total demand continues to increase? Just increase production through overtime. If it still needs to increase, a two-shift system will suffice.

What is a two-shift system? It is a common practice in China: a garment factory hires twice as many workers and divides them into day shifts and night shifts to work in rotation. The effect is similar to opening an additional factory, with production nearly doubled! At the same time, costs such as machinery, factory buildings, interest, and core management personnel salaries... have decreased by nearly half!

When two-shift systems are frequently implemented, The enterprise has already started production in the newly built factory.

Therefore, modern economics does not require the concepts of short run and long run, as they have little impact on prices. (Here's a funny one: the long run aggregate supply curve in modern economics is actually a vertical line! The reason is that in the long run, labor is limited, so supply cannot increase further. But for information products, from the second production, the cost is 0, and supply can be infinite. You can't possibly come up with the conclusion that supply is limited, even if you rack your brain!!!)

Important conclusions of cost and demand theory

Based on the theory of cost and demand, I have also drawn some extremely important conclusions:

1. The main feature of information products and high-end industrial products is that the technical cost is very high, but the technology can be copied at no cost!

Therefore, as long as we have good relations with the most advanced countries and humbly ask for advice from the most advanced researchers, it is equivalent to saving astronomical amounts of research and development funds! Used to improve people's livelihood. In addition, these great technologies that do not cost money can create astronomical amounts of wealth! The country will become rich!

The renowned Indian generic drugs serve as an example. Just imagine, if India were to rely solely on itself to develop these innovative drugs, it would be impossible for the entire country to succeed even if it were to invest all its wealth!

This is exactly the underlying logic of what Deng Xiaoping said: all countries that have good relations with the United States will become rich.

2. Current economics teaches us that a perfectly competitive market is the best, with the lowest prices, consumers benefiting the most, and resources being the most efficient in perfect competition. Monopoly is the worst, so laws are firmly established to combat monopoly.

However, the theory of cost and demand suggests that when the market is dominated by only two largest companies, it is already closest to monopoly, but it is the best! Because at this time, the economies of scale are large enough, and the cost is the cheapest.

For instance, there are currently only two super large aircraft companies in the world, Boeing and Airbus. Their mutual competition is the best for consumers. Imagine if there were many large aircraft companies in the world, each of which had to invest astronomical amounts of money in research and development, the cost of research and development per aircraft would definitely be shocking!!!

The best drink in the world is the cheapest in the world! Yes! I mean Coca Cola and Pepsi!

3. Current economics teaches us that the greater the demand, the higher the price (that is, the demand curve moves right) ; the less the demand, the lower the price.

However, The cost and demand theory holds that, It’s not that the more demand there is, the higher the price will be. Since the invention of Coke, the demand has increased infinitely! If this important conclusion of economics is correct, then Trump certainly can't afford to drink 12 cans of Coke a day!

Nor is it that the less demand, the lower the price.

Let me tell you a true story. Not long ago, I needed to use an incandescent bulb for testing when repairing an induction cooker. To my surprise, I couldn't find it in many nearby hardware and electrical stores! The next day, I went to another city to buy it, and the boss said that there were some in the warehouse, priced at 1.5 yuan each, and asked me to wait in the store. I waited for nearly half an hour, but he told me that he couldn't find them. I felt very strange and asked him, "Why are incandescent bulbs nowhere to be found now?" The boss said, "Actually, many years ago, people have already switched to energy-saving LED bulbs.

I remember the last time I bought an incandescent bulb was when I was young. Now the demand for incandescent bulbs has dropped by a thousand times. According to current economic theory, they should be as cheap as one cent for two bulbs. But taking inflation into account, the price remains unchanged, precisely because the cost hasn't changed!

I couldn't help but feel: life passes by like a fleeting moment. Times have changed, yet I remain unaware!

Answering question:

Question 1: There are already economies of scale in economics books!

It has indeed been mentioned in small quantities, but it has been marginalized as a special case due to its opposition to mainstream views. Otherwise, the supply curve you see in textbooks now will tilt downwards to the right.

The seriousness of this is that current economics analyzes various issues based on the upward-sloping supply curve, thus reaching conclusions that are contrary to the real world.

Question 2: When the demand for shirts increases by 100% in a month, the price will definitely skyrocket! The more demand there is, the higher the price! Economics is clearly correct!

What I mean is: under normal circumstances, as the population and income continue to grow, the demand for shirts continues to increase, increasing by 100% in ten years. Due to economies of scale, the cost of shirts has been reduced from 50 yuan/piece to 47 yuan/piece.

But in case of special circumstances, the demand for shirts will suddenly increase, causing companies to clear inventory and implement a two shift system, which still cannot meet the demand. This will indeed cause the supply curve to curve upwards to the right. But this situation only briefly occurs once in several decades, when China first joined the WTO.

Question 3: everyone thinks they are reasonable. You seem to be very reasonable, but the economic theory is also very reasonable!

In the three major textbooks of economics, the evidence that the supply curve tilts to the top right (that is, the more production, the higher the cost):

Example A: tomatoes, corn, wheat, wine grapes. The reason is that the cultivated land is exhausted. (this is only suitable for ancient times, and a large number of cultivated land are vacant in modern times).

Example B: sugar cone, oil, lollipop. No evidence was given.

Example C: pastry factory and coffee shop. The reason is that the commercial land is exhausted. (the scarce shops belong to imperfect competition).

Example D: violin. The reason is that the special wood is exhausted. (high end violins belong to imperfect competition).

And I think the evidence that the supply curve inclines downward to the right (that is, the more production, the lower the cost):

Example 1: cars, games, software. The reason is that technology (information) can be copied without cost.

Example 2: cars, shirts, coke, grain. The reason is economies of scale.